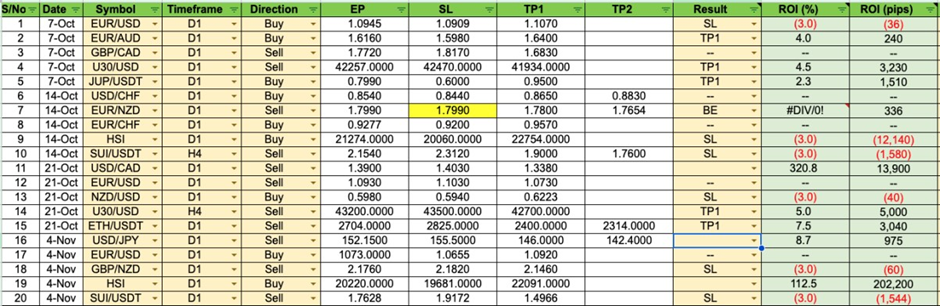

Last Week’s Trade Recap:

- USD/JPY Short – Price hit our sell limit and is in profits, continue holding

- EUR/USD Long – Price did not hit Buy limit before moving higher, cancel trade

- GBP/NZD Short – Hit SL

- HSI – Buy limit hit and is in profits, continue holding

- SUI – Hit SL

The Non-Farm Payrolls (NFP) report last week showed only 12,000 new jobs added, a much lower figure than anticipated. This slowdown reflects the impact of higher interest rates and tighter financial conditions, which have led businesses to pull back on hiring as they navigate rising costs and economic uncertainty. Furthermore, the U.S. presidential election concluded with Democratic candidate Kamala Harris narrowly defeating Republican incumbent Donald Trump. This outcome has introduced potential shifts in economic policy, particularly concerning fiscal stimulus and regulatory changes.

Key Market Events to Watch This Week:

- Federal Reserve Interest Rate Decision (Thursday, Nov 7): The market is pricing in a 25-basis point rate cut, which will lower the federal funds rate to a range of 4.5% to 4.75%, aiming to sustain economic growth amid global uncertainties.

- Bank of England (BoE) Monetary Policy Meeting (Friday, Nov 8): Market expectations lean towards a 25 basis point rate cut, which would bring the benchmark rate down to 4.75%. This anticipated move follows the BoE’s previous rate cut in August, the first in over four years, and reflects ongoing efforts to manage inflation and support economic growth.

- U.S. Presidential Elections: If Trump wins, expect potential USD strength due to pro-business policies, though trade tensions could spark gold demand as a safe haven. A Harris victory might lead to a weaker USD amid increased spending and debt concerns, supporting gold as an inflation hedge. The balance of power in the Senate and House will play a crucial role, as a divided Congress could limit significant policy shifts, stabilizing markets.

Forex

XAU/USD

This week will be a volatile week so we are looking to hedge all our positions regardless of the results of the US elections. We will be looking to scalp gold to the downside.

AUD/CAD

We are looking for a short position for a continuation of a downtrend short.

Cryptocurrencies

Ethereum

I expect the bottoming for Crypto to happen in these few days.

Join the Discussion!

Want to dive deeper into the world of trading and stay updated on the latest market trends? Join the Louna Labs Traders Community on Telegram! Connect with fellow traders, share insights, and access exclusive content.

👉 Join Louna Labs Telegram Channel

Don’t miss out on this opportunity to enhance your trading knowledge and be part of a vibrant community of like-minded individuals!